‘What would have happened had there been no responders?’

On the morning of July 5, Carrington Fire Chief Ken Wangen responded to this scene 9 miles southeast of Carrington near Bordulac, where a train derailed and caused a massive fire. Photo courtesy Stustman County Sheriff’s Office

On July 5, Carrington Fire Chief Ken Wangen had a call for a “locomotive fire.” When he arrived on scene about 9 miles southeast of Carrington near Bordulac, he found 29 rail cars carrying hazardous materials, including anhydrous ammonia, had derailed, causing a massive fire.

Thanks to the quick response by Wangen and other local responders, and with assistance from urban and rural fire departments in Jamestown, Kensal, Pingree, New Rockford, Sykeston, Harvey, Devils Lake and Rugby, there were no casualties.

“What would have happened had there been no responders?” ponders Wangen, who serves as president of the North Dakota Fire Chiefs Association.

“My incident here in Carrington would not have went as well if I had not been able to bring in the other rural areas to help, because it was something of that magnitude,” he says.

With the incident top of mind, Wangen is speaking out against a November ballot measure that will abolish property taxes in the state of North Dakota.

“Our ability to react quickly was due in large part to the resources funded by property taxes, which support our local fire and rescue services,” Wangen writes in a July 18 letter to the editor published in The Forum.

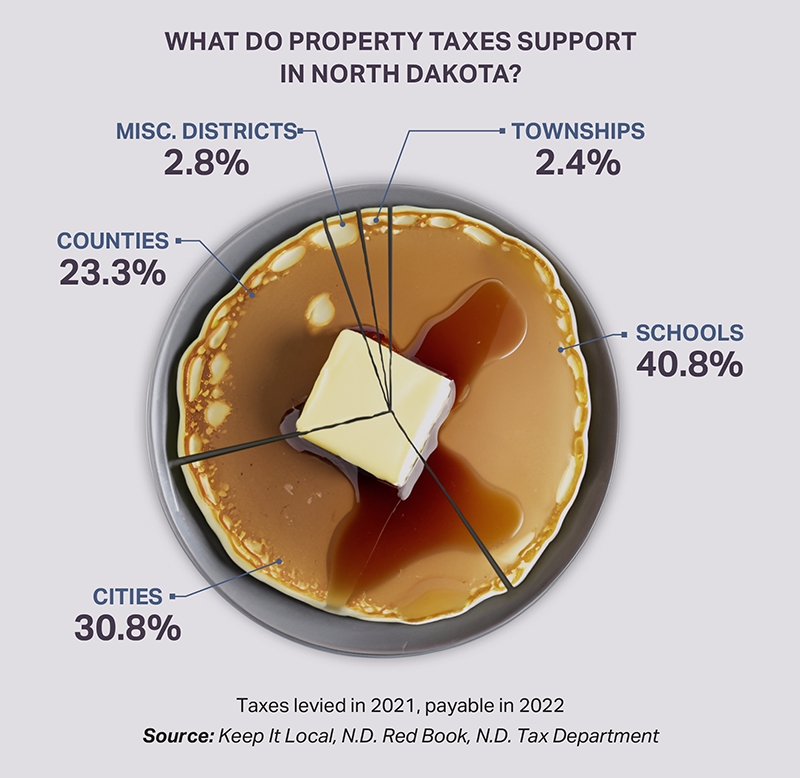

Property taxes are collected by local government to fund essential local public services, including schools (which receive the largest share of property tax funds), police, sheriff, fire, corrections, road maintenance, snow removal, street cleaning, water and waste management, public parks, pools, recreation facilities and libraries. Eliminating property taxes, as the November ballot measure intends, would mean a loss of $1.329 billion per year to those local public services.

That money would need to be made up somewhere. But where?

“Without (property tax) funding, I can guarantee I would lose (fire department) members. Because of budget restraints, we’re going to have to make that money up somewhere. And how do you do it? Selling raffle tickets? Some kind of fundraiser? The famous pancake feeds fire departments are known for?” Wangen says.

Opponents of the measure say there’s no well-vetted plan for where the money to replace property tax revenue would come from. They also say it would take away local control of the local budget.

The measure eliminates local governments’ primary funding tool, would only require the state to fund what was levied in 2024 for property taxes (all but ensuring the likelihood of future funding shortfalls) and transfers local decision-making from the hands of those who understand the needs of their local community to the state.

“I worry, if the measure to eliminate property taxes is approved by voters in November, that local control – a right we hold dear in North Dakota – will be stripped from us,” Wangen writes. “Local control ensures that our resources are allocated efficiently by those who understand our community’s unique needs, unlike a one-size-fits-all approach from state lawmakers, most of whom have never been to Carrington or even Foster County.”

In his community, Wangen says there are signs people understand why property taxes are needed. Voters in recent elections approved a property tax increase to support the Carrington ambulance service. And in the June primary election, voters in Foster County approved a property tax increase – from 12 mills to 25 mills – for the road department.

But people are also watching their pocketbooks, he says. Voters in the July 9 Carrington School District election turned down a ballot measure that would have maintained the current property tax level for school-related levies.

In all those elections, however, it was local people making decisions about their local community. That is something Wangen wants to see preserved – and why he’s urging fellow North Dakotans to vote “no” in November and defeat the property tax measure.

For Wangen, a first responder of 33 years with the fire service and 27 years with emergency medical services, it’s about community.

“It’s been ingrained in me from childhood. My parents were both extremely community-oriented people. Both volunteered for fire and ambulance in the small town of Goodrich, where I grew up,” he says. “It’s always just been, to me, the right way to be a good community citizen.”

And service.

“That’s a mantra of every (first responder): ‘If not me, who?’” Wangen says. “That’s our mentality, if it’s not me, who’s going to do this?”

___

Cally Peterson is editor of North Dakota Living. She can be reached at cpeterson@ndarec.com.

COALITION LAUNCHES TO PRESERVE PROPERTY TAX, LOCAL CONTROL

Electric cooperatives urge ‘NO’ vote on property tax measure

Editor’s note: At presstime, the property tax measure was awaiting official verification of the signatures needed to appear on the general election ballot. The N.D. Secretary of State has until Aug. 2 to verify the signatures.

A coalition launched in June to oppose the initiated ballot measure that seeks to abolish property tax in North Dakota. Keep It Local coalition members represent a broad spectrum of North Dakota interests, including agriculture, public safety, education, energy, cooperatives, business and local, city and county government.

The North Dakota Association of Rural Electric Cooperatives (NDAREC), whose members include 17 electric distribution cooperatives and five generation and transmission cooperatives operating in North Dakota, have joined the coalition. North Dakota’s electric cooperatives urge a “no” vote on the property tax measure.

“We all say we ‘back the blue’ and support law enforcement, our schools, our emergency responders, but how can we say that if we get rid of their main funding source, which is property tax?” says Josh Kramer, NDAREC executive vice president and general manager. “I get it, folks want property tax reform, and so do I. But it is irresponsible to pull the rug out from local government without having a plan in place to fund essential community services into the future. Abolishing property tax is not the answer, and property tax reform cannot be accomplished responsibly through a ballot measure changing the state constitution.”

“We represent industry, but we also represent community. We represent those who run the community, who live, work and raise families in the community,” Kramer says. “We don’t represent out-of-state landowners, who might be the one group who will benefit from the elimination of property taxes.”

North Dakota Living will provide more information on the property tax measure in the September issue. Visit www.keepitlocalnd.org to learn more.