Val Weigel, vice president of asset management and commodity strategy at Basin Electric Power Cooperative, discusses the February 2021 extreme weather event and subsequent emergency energy event on a panel at the cooperative’s annual meeting in November 2021. Photo by NDAREC/Liza Kessel

A year ago on Feb. 13, Bottineau broke records – reaching a new lowest daily temperature of 51 degrees below zero. It was the coldest temperature recorded in North Dakota in February 2021, according to the N.D. State Climate Office.

The extreme cold continued into Valentine’s Day and kicked off a widespread weeklong cold snap from North Dakota to Texas. Many low-temperature records were set throughout middle America during this sustained cold-weather event.

In response to the cold, consumer demand for electricity and natural gas grew, and a “perfect storm” scenario turned this 80-year weather event into an emergency energy event.

A year later, perhaps there’s still some gray area. What happened? Or maybe, other questions are top of mind. What have we learned? And could this happen again?

WHAT HAPPENED?

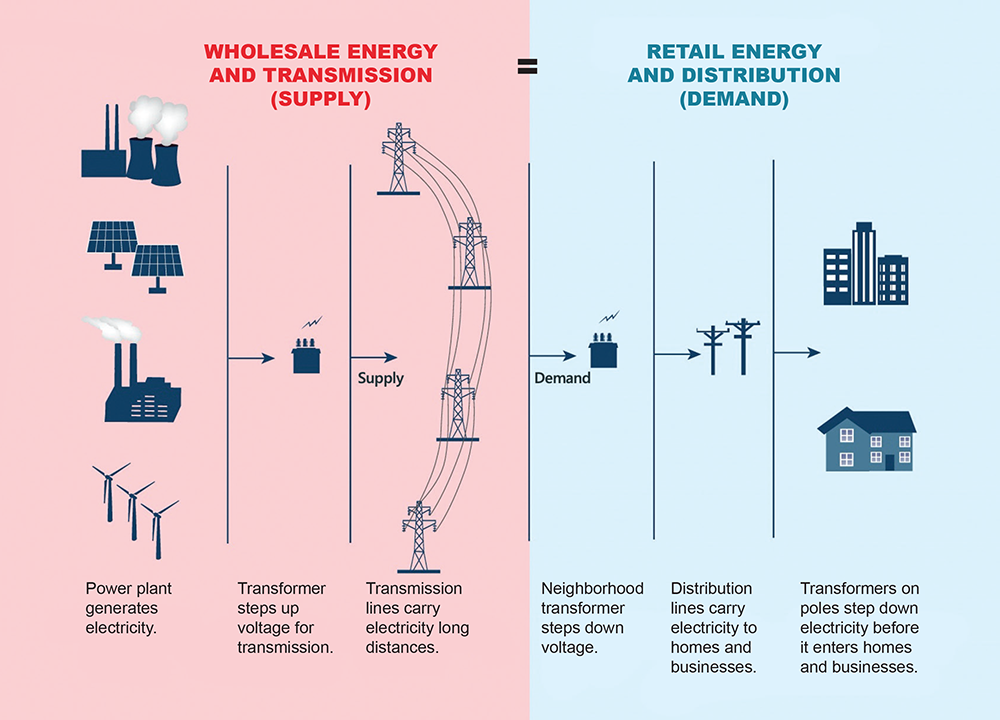

Southwest Power Pool (SPP) is one of two regional transmission organizations (RTO) with a footprint in North Dakota. Midcontinent Independent System Operator (MISO) is the other. As RTOs, SPP and MISO act as a balancing authority for member systems. They do not own generation assets, nor directly serve the electric load, but they are responsible for balancing supply and demand. Akin to the role air traffic control plays in the airline industry, ensuring planes and passengers get safely from point A to point B, RTOs monitor and direct the flow of power, on and off the bulk power grid, to ensure electricity gets from where it’s made to where it’s needed.

In the face of sustained, extreme cold last February, the generation available in SPP’s 14-state region, which stretches from North Dakota to northern Texas, was not enough to meet the increased demand for electricity.

“The bigger problems really came in the South, because they’re not used to that type of cold,” says Val Weigel, vice president of asset management and commodity strategy at Basin Electric Power Cooperative (Basin Electric), which is an SPP member. “Not only was it cold, but it extended for 10 days. The extreme cold temperatures cut off a lot of the natural gas production and supplies, and when that happens, then a lot of natural gas generation in the SPP market wasn’t able to run to serve the load.”

This temporary loss of significant natural gas production, including in Texas where natural gas pipelines froze, forced some generation facilities offline. The largest single cause of forced generation outages during this event was fuel-supply issues, causing nearly 47% of outages and affecting over 13,000 megawatts (MW) of gas generation, according to SPP. Without the generation needed to meet load requirements, the entire electric grid was dangerously tested.

Consider a vehicle in cruise control. When there’s a headwind or rise in elevation, horsepower must be increased to maintain speed. The power grid is no different, says Tom Christiansen, senior vice president of transmission, engineering and construction at Basin Electric.

“When (electric) load increases, 99% of the time, generation will follow. It will increase to meet the load,” he says. “That works well, until you have events where there isn’t adequate generation. If you don’t maintain 60 Hertz, bad things happen, ultimately resulting in blackouts.”

On Feb. 9, 2021, SPP declared “conservative operations” until further notice, and by Feb. 14, 2021, it requested member companies to issue public appeals for conservation. The next day, Feb. 15, 2021, SPP declared an Energy Emergency Alert (EEA) Level 3 – the first time it had declared a Level 2 or 3 alert in its 80-year history – as systemwide generating capacity dropped below power demand.

“When you run out of generation to adjust out of necessity, you must adjust load,” Christiansen says.

And that’s exactly what happened a year ago, when SPP directed its transmission operators to curtail electricity use by temporarily interrupting their customers’ electric service twice: once to lessen regional energy consumption by about 1.5% for 50 minutes Feb. 15, 2021, and again to lessen it by about 6.5% for about three hours Feb. 16, 2021. This strategy is commonly referred to as “load shedding” in the electric industry.

Some electric cooperative members in North Dakota experienced these controlled, temporary service interruptions.

Shutoffs in North Dakota were made by the Western Area Power Administration (WAPA), the primary transmission operator for electric cooperatives and municipalities in the region and one of four power marketing administrations within the U.S. Department of Energy. In some cases, WAPA had just 10 minutes to make decisions on what delivery points to shut off. Thus, electric cooperatives, and their members, had little to no notice of the power interruptions.

The protection measures, however, worked. The integrity of the grid was not compromised, and a far more devastating energy event was avoided.

RTOs AND MARKETS

Safe, reliable, affordable electricity is the promise cooperatives deliver to their members every day. To accomplish this, many links in the power supply chain must work in harmony to achieve a stable electric system, far before electricity is distributed to members’ homes, farms and businesses.

Your local electric cooperative, known as a distribution cooperative, relies on a wholesale power provider, or generation and transmission cooperative (G&T), to serve its load. Four G&Ts operate in North Dakota and serve the power and transmission needs of local distribution cooperatives: Basin Electric Power Cooperative, Central Power Electric Cooperative, Minnkota Power Cooperative and Upper Missouri Power Cooperative.

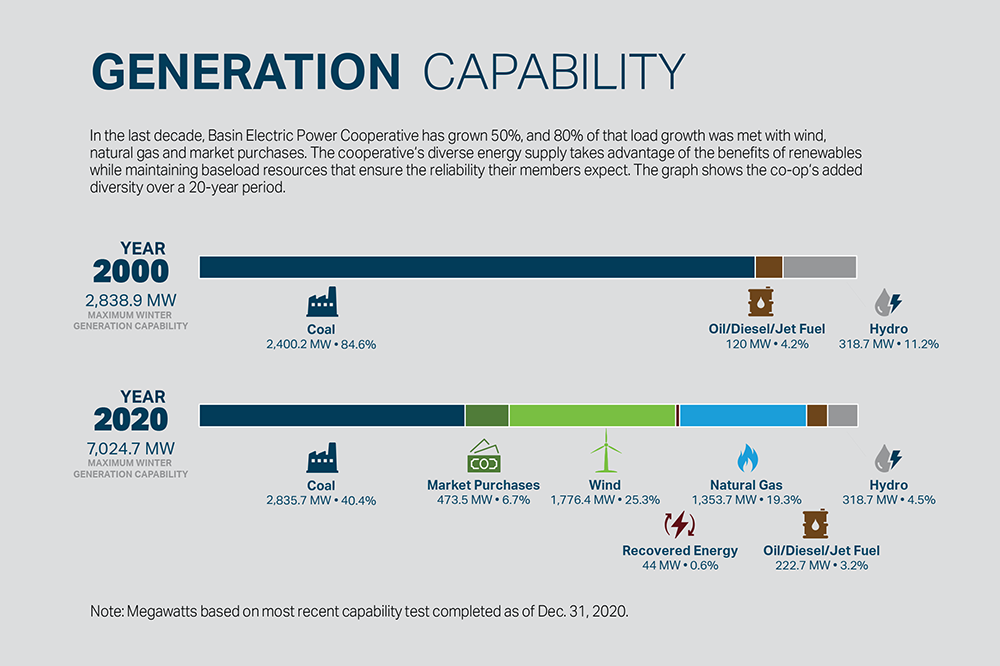

In the earlier electric system, a power provider would build and maintain its own generating unit or facility to serve its member load. This is why many of North Dakota’s lignite-coal facilities were built in the first place, to generate electricity for cooperative members across a multistate region.

“Everyone was kind of on their own, before RTOs,” Weigel says. “The industry has moved into a bilateral market today, where there’s a lot more trading going on. If one entity doesn’t have enough energy to cover their load, or their sales in a day, then they can go buy from another entity.”

“Once you move into an RTO, or a regional transmission organization, every market participant is collectively serving the load,” Weigel says. “Everyone brings all their generation and transmission assets to the table, then an RTO essentially runs the computer program and solves the equation of how to serve the collective load at the lowest cost.”

A major benefit to RTO membership, Weigel says, is having direct access to lower-cost power.

“If you look at the market in total, there are timeframes when we are buying more from the market than what our generation is running. And that’s because the market produces a lower-cost energy than our fleet can at given points in time,” Weigel says, which translates into lower power costs for the Basin Electric membership.

Another benefit of RTO membership is illustrated by the evening of Feb. 14, 2021, when one of Basin Electric’s coal plants, Lelands Olds Station Unit 2, was down for 36 hours due to a breaker failure. The cooperative was short of energy. If Basin Electric had been on its own island – self-reliant on its own generation – it would have been shedding load during that timeframe, Weigel says. Instead, its RTO, SPP, was able to deliver the additional power needed to carry Basin Electric’s load. No members experienced service interruptions due to this generating unit being offline.

Weigel says one of Basin Electric’s best assets, however, lies in the advantage of the cooperative model. By being part of a cooperative, resources are pooled, the risk is shared and objectives are accomplished that couldn’t be done alone.

“Because we have so much member load, we then have the economies of scale to build generation. We can build generation to size,” she says. “When you’re in a large scale, you can do things for better costs for megawatt-hours.”

Ultimately, striking a balance between owned generation and generation purchased on the open market has been an approach that’s worked for the Basin Electric membership.

Every day, Basin Electric’s marketing team forecasts what the cooperative’s load will be. Then, that load is bid into the market, Weigel says.

“Because we have generation, at the same time we’re buying our load, we’re getting paid for our generation,” she says. “That generation helps to hedge, or offset, power costs, which helps to net out that market price volatility.”

In the example of last year’s extreme energy event, SPP’S wholesale electricity market reached all-time high market prices in the day-ahead market on Feb. 15, 2021. Power was being offered at $4,274.96 per megawatt-hour (MWh). By comparison, the average energy price in the SPP day-ahead market for all of 2020 was $17.81 per MWh.

At those prices, Basin Electric’s February 2021 load costs through SPP were $1 billion. The following month, the cooperative’s load purchases totaled just $23 million, a mere 2% of February’s bill.

But Basin Electric was able to take advantage of those higher market prices, too, because while it was buying power, it was also selling its own generation in the market. The cooperative mitigated more than 90% of that $1 billion, Weigel says, by hedging its generation assets. If the cooperative was only purchasing power in the SPP market last February, cooperative members would have seen an extra $700 on their February electric bill.

“More and more, the last couple years with swings in natural gas prices, and with more renewable generation in the market, we are seeing an increasing level of price volatility,” Weigel says. “And because we have generation, and because our members are a part of our co-op, we help to smooth out that volatility that is present in the market.”

ACTION ITEMS

After the February 2021 event, there were many followups by North America Reliability Corporation (NERC) and a comprehensive review study by SPP to identify improvement areas for future extreme reliability threats. Five teams and hundreds of stakeholders conducted in-depth analysis and published the report, “A Comprehensive Review of SPP’s Response to the February 2021 Winter Storm,” which is publicly available on the SPP website.

The report recommended 22 actions, policy changes and assessments in nine core areas: fuel assurance; resource planning and availability; emergency response; operator tools, communication and processes; seams agreements; market design; transmission planning; credit and communications. The recommendations were then divided among three tiers, based on the urgency or completion timeline.

“(SPP) looked at every angle of that winter weather event,” Weigel says. “They put together a comprehensive project plan. A taskforce was created to address the Tier 1 items, in the fuel assurance and resource planning and availability categories. Those items tend to have a little bit longer timeframe for analysis, so a lot of those will be completed by 2023.”

Some key action items that have occurred since the February 2021 event include:

▶ Enhanced communications plan. SPP received much feedback on the communications gaps that occurred during the event. In December, SPP rolled out an enhanced emergency communications plan that ensures stakeholders have a dependable way to receive timely, accurate and relevant information during emergencies.

▶ Updated load-shedding plans. SPP determined the use of load-shed procedures was effective in preventing uncontrolled, more significant loss of load, but “could be improved to increase effectiveness and appropriateness of load-shed actions.” One of the first actions, Weigel says, was transmission operators working with their members to update load-shedding plans. These plans would include collaboration with distributing utilities to identify how and where load could be shed during a future emergency energy event.

▶ Generation maintenance reductions. SPP also reduced the amount of generation allowed to be in a planned outage, due to maintenance required, in its system during cold-weather timeframes.

▶ Winter preparedness plans. NERC also issued new standards following the event, requiring every generator to establish a winter preparedness plan. Some of the items included in these plans, Weigel says, are training staff and establishing fuel levels for cold-weather events.

COULD THIS HAPPEN AGAIN?

While the nation’s energy future continues to be a hot topic, the February 2021 event underscores the vital importance of prioritizing reliability in the energy discussion.

“Looking at reliability, some fuel sources provide faster ramping capability, while some are intermittent sources,” Weigel says. “Instead of the market focusing on (an energy) portfolio makeup, or saying we need this much wind, solar or other resource, the focus has been on reliability attributes the market needs.”

“SPP has not had an EEA event since the February event,” she continues. “The market really does a great job of looking at those reliability attributes and making sure that the resource portfolio in the market provides for that.”

But beyond the market, there is another safeguard in the system, which comes from simply being a cooperative member.

“Being a cooperative allows us to have economies of scale and a skilled staff in multiple areas,” Weigel says. “Maybe it’s negotiating fuel purchases or investing in a diversified skillset to manage congestion in the market. It’s allowing our own people, with cooperative values, to run our facilities. Above all, being part of a cooperative, you’re able to share in all those risks that exist in a micro area and provide benefits on a large scale to the membership.”

Cally Peterson is editor of North Dakota Living. She can be reached at cpeterson@ndarec.com.