Basin Electric Power Cooperative members enjoy the benefit of their own power marketing team, which provides 24/7 management of real-time markets, load forecasting, outage coordination and congestion management. Photo by NDAREC/Liza Kessel

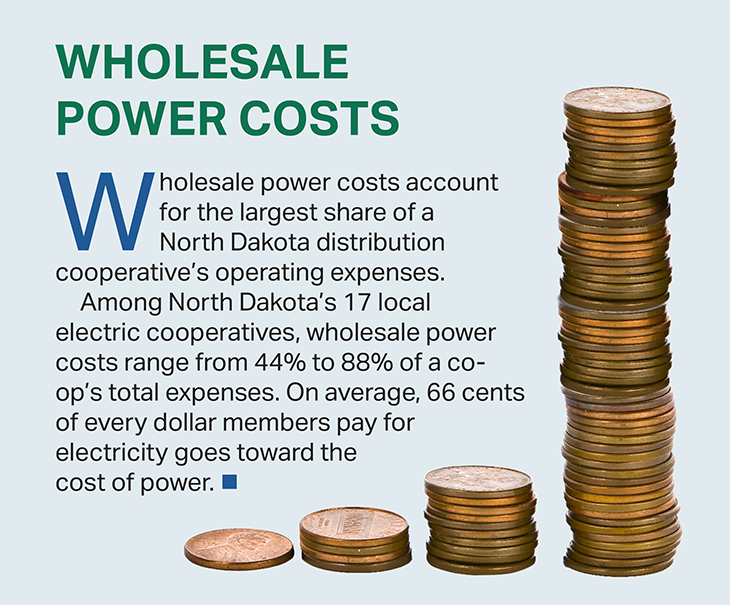

Wholesale power prices in the United States are expected to rise by 7% in 2025, according to the U.S. Energy Information Administration’s (EIA) Short-Term Energy Outlook published Jan. 27. Generally created on an hourly or daily basis, wholesale power prices are an indicator of the cost of generating power, the EIA explains.

Indeed, many regional wholesale power providers have announced rate increases after years of rate stability. Basin Electric Power Cooperative announced a 6.5% increase in 2025 and the Western Area Power Administration, which provides hydropower to many electric cooperatives in the region, will pass on nearly a 14% rate increase over two years.

“What we’re seeing in the power markets is greater demand driven by load growth and a need to build additional generation and transmission to serve the growing load reliably. The markets are becoming tighter,” says Val Weigel, Basin Electric senior vice president of energy markets and Dakota Coal operations.

The bulk power system today is more complicated and connected than ever before. The evolution of this network of power plants, generation resources and transmission infrastructure, however, has ensured a reliable flow of electricity at a more affordable price.

AN INTERCONNECTED GRID

AN INTERCONNECTED GRID

In the earlier network, a power provider would build and maintain its own generating unit or facility, such as a North Dakota lignite coal plant, to serve its member load.

“Everyone was kind of on their own,” Weigel says.

In the 1990s, the energy industry shifted to a market-based system. Every day, utilities forecast the amount of electricity needed to serve their loads. Then, that load is bid into the market.

“The industry (outside of RTOs) has moved into a bilateral market today, where there’s a lot more trading going on,” Weigel says. “If one entity doesn’t have enough energy to cover their obligations, or their sales in a day, then they can go buy energy from another entity.”

This industry shift added another layer of complexity to the power grid with the introduction of regional transmission organizations (RTOs) and independent system operators (ISOs).

RTOs and ISOs manage the day-to-day electricity transmission needs for 190 million people and plan for the long-term needs of the electric power system in their service areas, the Federal Energy Regulatory Commission describes. Though they do not own generation assets nor directly serve the load, RTOs and ISOs are responsible for balancing supply and demand. They are the air traffic controllers of the electric grid, monitoring and directing the flow of power on and off the bulk power grid to ensure electricity gets from where it’s made to where it’s needed.

In an RTO or ISO, market participants pool their generation and transmission resources.

“Every market participant is collectively serving the load,” Weigel says. “Everyone brings all their generation and transmission assets to the table, then an RTO essentially runs the computer program and solves the equation of how to serve the collective load at the lowest cost and in the most reliable way.”

A major benefit of RTO membership, Weigel says, is having direct access to lower-cost power.

“If you look at the market in total, there are timeframes when we are buying more from the market than what our generation is producing. And that’s because the market produces a lower-cost energy than our fleet can at given points in time,” Weigel says, which translates into lower wholesale power costs for the Basin Electric membership.

Another benefit of RTO membership is illustrated by the evening of Feb. 14, 2021, when one of Basin Electric’s coal plants, Leland Olds Station Unit 2, was down for 36 hours due to a breaker failure during a widespread cold snap that stretched from North Dakota to Texas. If Basin Electric had been self-reliant on its own generation during that timeframe, Weigel says the cooperative would have been at greater risk of shutting off power, or “shedding load,” as it’s referred to in the industry.

“Thank goodness we had a market, because we had other sources we could rely on,” Weigel says.

Another way to think about the electric grid is a giant spider web, says Chris Baumgartner, Basin Electric senior vice president of member and external relations.

“On that spider web, you have people taking electricity off that grid and you have generators putting it on, and it all has to happen simultaneously, because electricity is in real time. It's really not stored. So, everything has to balance, right? … And so, we work with these regional organizations so that we can better coordinate that. In doing that, we are sharing our transmission and our generation resources, and that means more people and more complexity. But at the end of the day, we hope it means more affordability,” he says.

MARKET VOLATILITY

Increasing demand, a changing resource mix, the retirement of reliable baseload generation and lagging transmission infrastructure are creating volatility in today’s wholesale power market.

“What we are seeing in the market is there’s not a lot of excess power out there,” Baumgartner says. “We are efficiently, effectively using the electricity available to serve the needs of the public,” but the demand growth for electricity presents “extraordinary needs.”

In its 2024 Long-Term Reliability Assessment released in December, the North American Electric Reliability Corporation (NERC) predicts surging demand growth over the next 10 years, while new generation lags and less dispatchable capacity remains on the system, as generators retire and are replaced with more variable, weather-dependent resources.

“The trends point to critical reliability challenges facing the industry: satisfying escalating energy growth, managing generator retirements and accelerating resource and transmission development,” the NERC report states.

Meeting the growing energy demand has become “more challenging and complex as coal-fired and older natural gas-fired generators retire and are replaced by variable and energy-limited resources,” NERC says. This changing resource mix and having less always-available, dispatchable generation in the market has added to the price volatility.

Basin Electric has felt the impact of market dynamics. Changes in power generator types and increasing electric demand have produced higher wholesale power market prices at peak times, when consumers use the most energy during the day and in extreme weather conditions.

“If you go back four or five years, we saw a significant increase in renewables entering the grid, coal retirements and a shift in the resource mix serving our load,” Weigel says. “To make sure all market resources are fairly compensated for their capacity, the markets are revising their planning reserve margin rules. As a result, resources with higher availability will receive a larger percentage of their resource accredited compared to those with lower availability. This will help to ensure the market can rely on reliable resources to meet the demand.”

This means market participants are increasing their generation capacity and investing in critical generation and transmission infrastructure. Basin Electric is investing almost $8 billion over the next 10 years in transmission and generation assets to ensure reliable electricity for its members. In January, the cooperative announced plans to build a nearly $4 billion, 1,470-megawatt natural gas-fueled generation facility in Williams County – one of the largest electric generation projects in Basin Electric’s history.

“It seems like a never-ending challenge to keep up with load growth, and this plant will go a long way in meeting that demand,” says Gavin McCollam, Basin Electric senior vice president and chief operating officer. “Basin Electric has been increasing its renewable portfolio over the years, and this natural gas facility will fill in the gaps when wind and solar are not available.”

But projects like this take time and often face regulatory, siting, land acquisition, easement or other challenges. And wholesale power providers are also feeling the effects of inflation and increasing material and input costs.

“We’re utilities. We know how to do it. It’s just going to take some time, because there’s going to have to be more resources built,” Baumgartner says.

The cost to build those resources will be shared among power purchasers, passed on through wholesale power costs and reflected in market prices.

“In today’s world, to make sure we can serve our members, one thing we are willing to pay for is reliability. Affordability and reliability is our north star,” Weigel says.

THE COOPERATIVE ADVANTAGE

Safe, reliable, affordable electricity is the promise cooperatives deliver to their members every day.

Distribution cooperatives rely on a wholesale power provider, or generation and transmission cooperative (G&T), to serve its load. Four G&Ts operate in North Dakota and serve the power and transmission needs of local distribution cooperatives: Basin Electric, Central Power Electric Cooperative, Minnkota Power Cooperative and Upper Missouri Power Cooperative.

The cooperative model provides many advantages, Weigel says. By being part of a cooperative, resources are pooled, the risk is shared and objectives are accomplished that couldn’t be done alone.

“Because we have so much member load, we then have the economies of scale to build generation. We can build generation to size,” she says. “When you're operating on a large scale, you can achieve more cost-effective megawatt-hours.”

“Because we have generation, at the same time we’re buying our load, we’re getting paid for our generation,” Weigel says. “That generation helps to hedge, or offset, power costs, which helps to net out the market price volatility.”

Perhaps the greatest advantage, however, is cooperatives are owned by the consumers they serve. They don’t return money to shareholders and seek to provide the lowest-cost power reliably.

“I drank the co-op Kool-Aid,” says Baumgartner, a North Dakota farm kid who started working for cooperatives as a college student in 1992. “It’s people working together for a common goal and ultimately achieving something together they could not do alone.”

Find the final feature in the “Cost of Your Power” series in the April issue of North Dakota Living.

___

Cally Peterson is editor of North Dakota Living. She can be reached at cpeterson@ndarec.com.

EDITOR’S NOTE:

In North Dakota, electric cooperative rate making is a function of local electric co-op boards of directors, which are democratically elected from the membership by the co-op members. Electric co-op boards weigh many factors when determining rates and balancing reliability, safety and affordability.

Across the country, many electric cooperatives (though not all) have implemented, are considering or will consider a rate increase. The Cost of Your Power series will present some of the current industry-wide, high-level pressures which factor into rate-making decisions by electric cooperative boards. This series will not include information specific to your local electric cooperative. Contact your local electric cooperative for information about your electric rates.